What is an IRS Levy?

When taxpayers do not pay delinquent taxes, the Internal Revenue Service (“IRS”) can work directly with financial institutions and other third parties to seize the taxpayer’s assets. This action is commonly referred to as a “levy.”

The IRS levy is an administrative tool that the IRS can use to collect unpaid taxes.

When Does the IRS Issue Levies?

While the IRS has this power, it often uses the power sparingly.

The IRS generally levies on property when it:

- Has not been successful in collecting taxes via other avenues and

- Becomes aware of assets that:

This can include levying on your bank accounts, your Social Security or VA benefits, your tax refunds, and even your paychecks. There are nuances, but the IRS usually cannot levy on foreign assets.

Notice of the IRS Levy

The IRS is required to send you notice of its intention to levy at least 30 calendar days before initiating the levy action. This is often done by sending you a warning letter in the mail.

The IRS Restructuring and Reform Act of 1998 expanded upon this notice requirement. It added I.R.C. § 6330 to the Code. Section 6330 requires the IRS, in addition to giving you 30 calendar days’ notice of the IRS’s intent to levy, to also notify you on the first notice of intent to levy of your right to request a Collection Due Process (“CDP”) hearing. The CDP hearing is an administrative process at which you can raise various issues with respect to the proposed levy.

The IRS is required to notify you again prior to levy whenever any new (i.e., additional) tax assessments are applied to your IRS account.

The IRS notifies you of its intent to levy by sending a Letter 11 or Letter 1058, Final Notice – Notice of Intent to Levy and Notice of Your Right to

a Hearing.

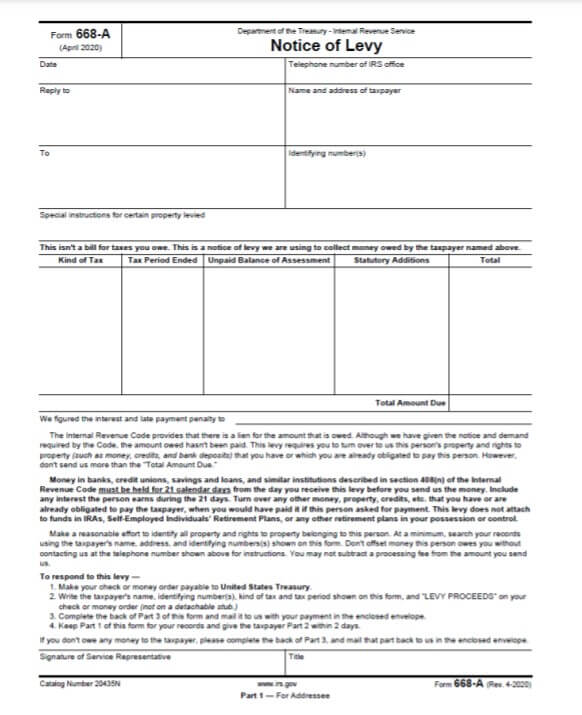

The actual levy is usually on Form 668-A, which is depicted in the picture. This notice tells the third party to pay the amount owed to the taxpayer to the IRS.

About the CDP Hearing

Section 6630 requires that all levy actions be suspended during the 30 calendar days prior to the levy issuance for those periods that are the subject of the requested hearing, as well as throughout the entire period that a hearing (including any appeals from the hearing) is pending.

CDP rights include the right to a fair and impartial hearing before the Office of Appeals. The notice required by I.R.C. § 6330 must include the amount of unpaid tax, the right to request a CDP hearing, and the proposed action the IRS intends to take, along with other important information on topics, such as collection alternatives

Exception When No Notice Required

The law provides an exception to the 30–calendar-day notice requirement for certain situations, such as levies on a state tax refund, levies on Federal contractors, disqualified employment tax levies, and jeopardy levies.

The IRS still has to provide you with notice of your CDP rights within a reasonable period of time after these levies.

For bank levies, you may find that the bank notifies you of the levy long before you get the IRS’s letter.

If you receive a notice of levy, you should act fast. There is often a limited amount of time to avoid having the IRS take your property.

How Does the IRS Issue Levies?

The IRS may issue levies through the Automated Collection System (ACS), Field Collection, or one of the IRS’s Automated Levy Programs (ALP).

The ACS is an IRS group that focuses on collections. It is staffed by collection representatives who interact with delinquent taxpayers by telephone to collect unpaid taxes and secure tax returns. The ACS function issues the following levies:

- Systemic levies – generated by the ACS Systemic Levy Program.

- Paper levies – issued by collection representatives through the ACS.

- Manual levies – issued by collection representatives after manually typing the levy.

IRS collection employees may also issue levies. This includes revenue officers who are tasked with contacting taxpayers with delinquent accounts. Revenue officers contact taxpayers in person and over the phone. Cases assigned to revenue officers in the field offices are controlled and monitored on the Integrated Collection System (ICS). Field employees issue two types of levies:

- Systemic levies – issued by revenue officers through the ICS.

- Manual levies – issued by revenue officers after manually typing the levy.

The ALP is the IRS’s computer system. It issues levies electronically without employee action. The proceeds are then received electronically. The ALP issues the following levies:

- Federal Payment Levy Program – attaches to Federal disbursements due to an individual or business, such as Federal wages, retirement, vendor/contractor payments, and Social Security. It also issues Federal contractor levies and disqualified employment tax levies, which have different legal requirements than the other Federal Payment Levy Program levies.

- State Income Tax Levy Program – attaches to participating State income tax refunds.

- Municipal Tax Levy Program – attaches to participating local municipal income tax refunds.

- Alaska Permanent Fund Dividend Levy Program – attaches to the PermanentFund Dividend distributed by Alaska.

Three Types of IRS Levies

These levies will either be paper levies, manual levies, or systematic levies.

A “paper levy” is a levy generated on a Form 668-A or Form 668-W, Notice of Levy on Wages, Salary and Other Income, and issued through the ACS either systemically or by an employee.

A “manual levy” is a paper levy form that is manually prepared and issued by a revenue officer. A manual ACS levy is initiated through the system by a collection representative, resulting in levy preparation and issuance by the system.

A “systematic levy” is an ACS levy that is initiated, prepared, and issued completely by the ACS with no manual intervention necessary. ICS systemic levies are initiated by revenue officers resulting in levy preparation and issuance by the system.

IRS Levies Create Hardships

IRS tax levies can create financial hardships.

This can put you in the position of not being able to operate your business or even to pay your family’s monthly bills. In addition, they can destroy your employer-employee relationships and IRS bank levies can destroy your access to future bank credit.

If the IRS issues an IRS tax levy, it is imperative that you immediately contact an experienced tax attorney.

Wrongful Levies

Just because the IRS issues a levy does not mean that the IRS complied with our tax laws. The IRS has a track record for wrongful levies. The IRS has even levied on property when the underlying tax dispute was being challenged in court.

The term “wrongful levy” usually refers to levies on property that you do not own. Our tax laws provide remedies for third parties whose property is wrongfully levied by the IRS.

Frequently Asked Questions About IRS Levies

Is a tax levy bad?

Usually, yes. This means that the IRS has not been able to collect from you. It also means that the IRS is likely to take your assets, such as cash in your bank accounts.

Does the IRS have to notify you of a levy?

Yes, see the notice requirements described above.

Can the IRS take money from your bank account?

Yes, the IRS can and does take money from bank accounts. This is one of the most common types of assets that the IRS levies on. The right to receive wages from an employer is also common. A wage levy can be particularly problematic as it can negatively impact the employer’s view of the taxpayer.

How often can the IRS levy my bank account?

There are no restrictions on how often the IRS can levy on your bank accounts. The levy only captures funds in the account on the day the bank receives the levy. So the IRS may need to issue multiple levies on your bank accounts.

Can the IRS take your car?

Yes, the IRS can levy on a car. This would need to be a manual levy instituted by an IRS revenue officer.

How do I stop an IRS levy?

You can stop a levy by timely-filing a CDP hearing request. You may also stop the levy by contacting the IRS ACS or the revenue officer that filed the levy.

What happens when the IRS puts a levy on you?

This depends on the type of IRS levy. If it is a bank levy or wage levy, your bank or employer will usually contact you to notify you of the levy and then they will provide the cash or wages to the IRS pursuant to the levy. This means that they will remit your money to the IRS.

It is then up to you to work with the IRS to get the levy released. The IRS can and will often release levies.

Help With an IRS Tax Levy

We are experienced tax attorneys in Houston, Texas. We help clients with IRS levies and other collection matters. This includes helping clients get levy releases.

If you need help with an IRS levy or have questions about IRS levies or need a levy release, please contact us.

We can be reached at (713) 909-4906 or you can schedule an appointment with our tax attorneys to discuss your IRS levy.

Articles About IRS Levies

- Transferring Property to a Spouse to Avoid IRS Collections

Imagine you live in a community property state, like Texas, and jointly own a home with your spouse. You owe back taxes to the IRS and want to protect your share of the home if the IRS tries to seize… Continue reading Transferring Property to a Spouse to Avoid IRS Collections

Imagine you live in a community property state, like Texas, and jointly own a home with your spouse. You owe back taxes to the IRS and want to protect your share of the home if the IRS tries to seize… Continue reading Transferring Property to a Spouse to Avoid IRS Collections - Court Rejects IRS Claim to Taxpayer’s Property

If a bank loans money to a business to buy equipment when the business owes back taxes, can the bank foreclose on and repossess the equipment? Does the bank or the IRS have a superior interest in the equipment? This… Continue reading Court Rejects IRS Claim to Taxpayer’s Property

If a bank loans money to a business to buy equipment when the business owes back taxes, can the bank foreclose on and repossess the equipment? Does the bank or the IRS have a superior interest in the equipment? This… Continue reading Court Rejects IRS Claim to Taxpayer’s Property - Start a New Business to Avoid Old Taxes

Payroll taxes kill businesses. It is very easy to get behind, whether the business owner uses the funds to pay other expenses or due to a mistake. Once there is a payroll tax balance, it can be very difficult to… Continue reading Start a New Business to Avoid Old Taxes

Payroll taxes kill businesses. It is very easy to get behind, whether the business owner uses the funds to pay other expenses or due to a mistake. Once there is a payroll tax balance, it can be very difficult to… Continue reading Start a New Business to Avoid Old Taxes

And even more about unpaid tax debts and IRS levies.

In 40 minutes, we'll teach you how to survive an IRS audit.

We'll explain how the IRS conducts audits and how to manage and close the audit.